The Korean financial landscape presents a fascinating paradox: while Koreans demonstrate financial literacy scores above the OECD average, many individuals—particularly young adults—find jaetech (재테크, or financial technology and investment management) overwhelmingly complex and intimidating. This comprehensive analysis explores the multifaceted barriers that make jaetech feel difficult, examines current market behaviors and educational gaps, and provides evidence-based insights into how financial management can be made more accessible to Korean consumers.

The Korean Financial Literacy Paradox

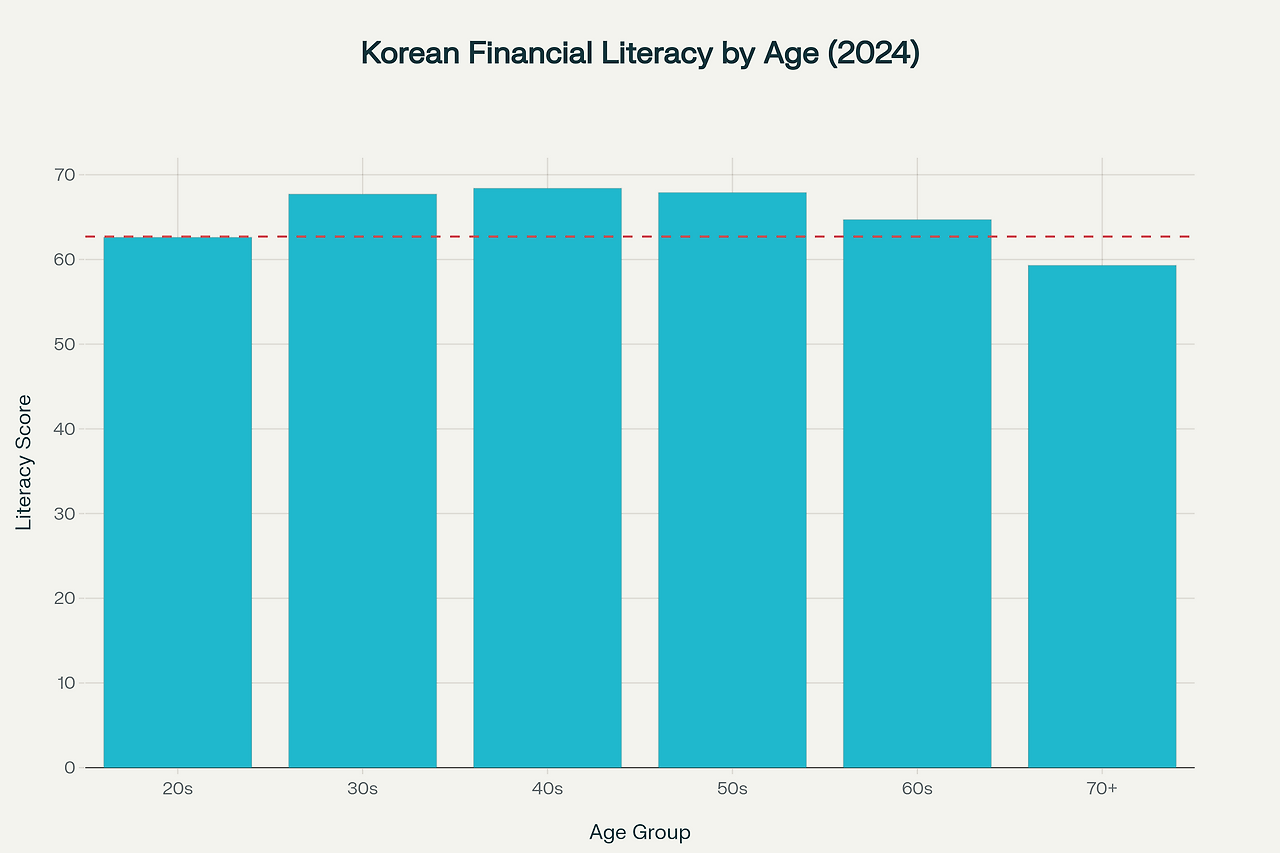

Despite achieving a financial literacy score of 65.7 points in 2024—significantly higher than the OECD average of 62.7—Korean adults face substantial challenges in practical financial management. This contradiction reveals that theoretical knowledge doesn't necessarily translate into confident, effective financial decision-making. The complexity of jaetech stems from a confluence of structural, educational, and psychological factors that create barriers even for individuals with basic financial knowledge.

Declining Understanding of Fundamental Concepts

One of the most concerning trends in Korean financial literacy is the dramatic decline in inflation understanding. Between 2022 and 2024, Korean adults' comprehension of how inflation affects purchasing power plummeted from 78.3 points to 56.6 points—a devastating 27.7% decrease. This decline occurred precisely when inflation knowledge became most critical, as the country experienced significant price increases with the consumer price index surging 5.1% in 2022, the steepest climb since 1998. The timing of this knowledge gap highlights how disconnected theoretical financial education can become from real-world application.

Information Overload in the Digital Age

The Flood of Fragmented Knowledge

The digital revolution has created an unprecedented volume of financial information accessible to Korean consumers. From stocks and bonds to real estate, cryptocurrencies, and complex derivatives, the sheer breadth of available investment options creates decision paralysis. Korean retail investors now account for 64% of stock market transactions—nearly double the proportion seen in the United States or Japan (30%)—yet this increased participation has not led to improved outcomes.

This information abundance manifests in several problematic ways. First, the quality and reliability of financial content varies dramatically across platforms, making it difficult for beginners to distinguish between sound advice and speculation. Second, the rapid pace of financial innovation means that educational materials quickly become outdated, leaving investors struggling to keep up with new products and strategies. Third, the democratization of financial information has led to an overwhelming number of "expert" voices, each promoting different approaches and philosophies, creating confusion rather than clarity.

The Rise of Social Media Financial Influence

The emergence of financial influencers on platforms like YouTube and Instagram has both simplified and complicated the jaetech landscape. While these platforms make financial education more accessible, they also contribute to information overload and can promote unrealistic expectations. The popularity of terms like "Weolbu" (월부, meaning "salaried and rich") reflects young Koreans' desire for financial security, but also reveals the pressure they feel to achieve rapid wealth accumulation. The Weolbu platform has exploded from 150,000 users in 2023 to over 1.5 million users by 2024, demonstrating the massive demand for financial guidance among young adults.

https://www.youtube.com/watch?v=FluqEgu1Obo

High school students learn about investment and loans in a new financial education class, addressing the complexity of managing finances

Technical Jargon as a Barrier to Entry

Language Complexity in Korean Financial Markets

The Korean financial sector's heavy reliance on technical terminology creates significant barriers for newcomers to jaetech. Terms like compound interest (복리), leverage (레버리지), diversification (분산투자), and asset allocation (자산배분) can intimidate individuals without formal financial education. This linguistic barrier is compounded by the prevalence of English loanwords in Korean financial terminology, creating a hybrid vocabulary that can be particularly challenging for older adults or those with limited English proficiency.

The complexity extends beyond individual terms to encompass entire conceptual frameworks. For example, understanding modern portfolio theory requires grasping concepts of correlation, volatility, and risk-adjusted returns—ideas that demand both mathematical literacy and financial sophistication. When these concepts are presented in academic or professional contexts without adequate translation into everyday language, they become insurmountable obstacles for many potential investors.

The Translation Challenge

Research has shown that technical terminology translation between English and Korean presents ongoing challenges, particularly in rapidly evolving fields like finance. As new financial products and concepts emerge globally, Korean translations often lag behind, creating periods where Korean investors must navigate English-language resources or rely on imperfect translations. This linguistic gap contributes to the perception that jaetech is an exclusive domain requiring specialized education.

Psychological Barriers and Risk Aversion

Fear-Driven Decision Making

The connection between money and survival creates profound psychological barriers to financial engagement. For many Koreans, particularly those who experienced economic instability during events like the 1997 Asian Financial Crisis, investment carries existential anxiety that extends beyond rational risk assessment. This fear manifests in several ways: analysis paralysis when faced with investment decisions, tendency to delay financial planning, and preference for low-risk options that may not meet long-term financial goals.

The psychological impact is particularly pronounced among young adults who face unique economic pressures. With youth unemployment higher than the OECD average and 20.9% of young people not in education, employment, or training, the stakes of financial decision-making feel especially high. The fear of making wrong choices can prevent young adults from engaging with jaetech altogether, creating a self-reinforcing cycle of financial exclusion.

Behavioral Biases in Korean Markets

Korean retail investors demonstrate several well-documented behavioral biases that complicate their jaetech experience. Research analyzing 200,000 investors during 2020 revealed patterns of overconfidence, disposition effect (holding losing positions while selling winners), and attention bias toward stocks with recent price spikes. These biases lead to suboptimal investment outcomes: 46% of retail investors experience losses, and this percentage rises to 61% for new investors even during favorable market conditions.

The prevalence of herding behavior among Korean investors has intensified with increased retail participation. A 30-year analysis of Korean market data shows that growing retail investor numbers significantly amplify herding behavior, particularly during market downturns when psychological biases like excessive risk aversion and fear of missing out (FOMO) drive collective decision-making. This herding tendency contributes to market volatility and often results in poor timing of investment decisions.

Goal Confusion and Lack of Financial Planning

The Absence of Clear Objectives

One of the most significant barriers to effective jaetech is the lack of clearly defined financial goals among Korean consumers. Survey data reveals that while 25.8% of Korean adults identify home buying as their primary long-term financial goal, followed by asset accumulation (19.9%) and wedding expenses (13.9%), many individuals attempt to pursue multiple objectives simultaneously without prioritizing or creating coherent strategies. This goal confusion leads to scattered efforts and suboptimal resource allocation.

The problem is exacerbated by cultural and social pressures that create conflicting priorities. Young adults face pressure to achieve homeownership, prepare for marriage, support aging parents, and build retirement savings—often simultaneously and without adequate income to address all objectives. This multi-directional pull creates stress and makes jaetech feel overwhelming rather than empowering.

Life Cycle Financial Planning Gaps

Korean financial education has traditionally focused on product knowledge rather than life cycle financial planning. While consumers may understand the mechanics of various investment products, they often lack frameworks for integrating these tools into comprehensive financial strategies. The absence of systematic approaches to financial planning means that individuals must construct their own frameworks, often leading to suboptimal decisions and increased anxiety about financial security.

Social Pressure and Comparison Culture

The "Success Story" Phenomenon

Social media and traditional media constantly showcase investment success stories, creating unrealistic expectations and social pressure among Korean consumers. The emergence of terms like "Yeongkkeul-jok" (영끌족, meaning young people who stretch their finances to invest) reflects the extreme measures some individuals take to participate in investment markets. These success narratives often omit the risks, failures, and luck involved in investment outcomes, creating distorted perceptions of what constitutes normal or achievable results.

The pressure is particularly intense in Korea's highly connected society, where financial status often correlates with social standing. Young adults report feeling "left behind" when they see peers making investment gains, leading to FOMO-driven decisions that prioritize speed over strategy. This social dynamic transforms jaetech from a personal financial planning tool into a competitive arena, increasing stress and reducing the likelihood of sound decision-making.

Generational Investment Behavior Shifts

The generational divide in Korean investment behavior reflects broader changes in economic conditions and social values. Younger investors increasingly abandon domestic Korean stocks in favor of U.S. markets and cryptocurrency, with Korean investors' holdings of U.S. stocks reaching a record $112.1 billion at the end of 2024. This shift represents more than portfolio diversification; it reflects young Koreans' pessimistic outlook on domestic economic prospects and their search for higher returns in global markets.

The trend toward international and alternative investments, while potentially beneficial for diversification, adds complexity to jaetech decisions. Young investors must now navigate multiple regulatory environments, currency risks, and market conditions, significantly increasing the knowledge and skills required for effective financial management.

Current Educational Gaps and Initiatives

Institutional Financial Education Efforts

The Korean government and financial sector have implemented various educational initiatives to address jaetech complexity. The Financial Supervisory Service (FSS) operates comprehensive financial education programs, including university student volunteer groups that have provided education to approximately 258,000 people since 2012. The Korea Council for Investor Education (KCIE) offers online educational resources through its School Series programs, covering topics from asset allocation to retirement planning.

Despite these efforts, significant gaps remain in practical application and accessibility. Traditional financial education focuses heavily on theoretical concepts and product explanations rather than decision-making frameworks and behavioral awareness. The recent partnership between the FSS and Hana Financial Group to provide tailored education in North Chungcheong Province represents an evolution toward more targeted, regional approaches.

Digital Education Platform Development

The government's plan to launch an online platform for microfinance assistance in 2024 represents recognition that digital tools can improve accessibility to financial services and education. However, the digital divide remains a significant challenge, particularly for older adults and individuals with limited technological literacy. Research shows that while 97.1% of Koreans have access to digital devices, the gap between device ownership and effective usage creates ongoing barriers.

International Comparison and Best Practices

Australian financial education programs, highlighted in Korean policy discussions, emphasize real-life integration and participatory learning rather than theoretical concept explanation. The Australian approach focuses on practical application—teaching students to develop savings strategies and understand credit card usage in real-world contexts. This contrasts with Korean programs that traditionally emphasize definitional knowledge of financial terms and products.

The Path Forward: Simplifying Jaetech

Systematic Approach to Financial Planning

The most effective strategy for reducing jaetech complexity involves implementing systematic, goal-oriented approaches to financial planning. Rather than attempting to master all available financial products and strategies, individuals should begin with clear objective-setting and work backward to identify appropriate tools and methods. This approach reduces decision paralysis and provides a framework for evaluating new information and opportunities.

Financial planning should be structured as a series of manageable steps: emergency fund establishment, debt management, basic investment portfolio construction, and advanced strategy implementation. Each step should be completed and understood before moving to the next level, preventing the overwhelming sensation that occurs when individuals attempt to address multiple complex financial challenges simultaneously.

Behavioral Awareness and Education

Addressing behavioral biases requires explicit education about common psychological traps in financial decision-making. Korean financial education programs should incorporate modules on overconfidence, herding behavior, and loss aversion, providing individuals with tools to recognize and counteract these tendencies. Understanding these biases can help investors make more rational decisions and avoid common pitfalls that lead to poor investment outcomes.

The integration of behavioral finance concepts into mainstream financial education represents a significant opportunity for improving jaetech accessibility. By acknowledging the emotional and psychological dimensions of financial decision-making, education programs can better prepare individuals for the realities of investment management.

Technology-Enabled Simplification

Digital tools can significantly reduce jaetech complexity by providing personalized guidance, automated decision-making support, and simplified interfaces for complex financial tasks. Robo-advisors, goal-based planning applications, and educational platforms that adapt to individual knowledge levels can make sophisticated financial management accessible to broader populations.

However, technology solutions must be designed with user experience and accessibility in mind. Complex applications that simply digitize traditional financial products without addressing underlying complexity may actually increase barriers rather than reducing them.

Conclusion

The perception that jaetech is difficult and complicated stems from legitimate structural and educational challenges in the Korean financial landscape. Information overload, technical jargon, psychological barriers, goal confusion, and social pressure create genuine obstacles to effective financial management. However, these challenges are addressable through systematic educational reform, behavioral awareness, and thoughtful technology implementation.

The key insight is that jaetech complexity is often presented as necessary when it is actually a consequence of how financial information and products are organized and communicated. By focusing on goal-oriented planning, behavioral awareness, and step-by-step skill building, Korean consumers can transform jaetech from an overwhelming challenge into an accessible tool for financial security and prosperity.

Success in simplifying jaetech requires coordinated efforts from government, financial institutions, and educational organizations to prioritize practical application over theoretical knowledge, behavioral understanding over product promotion, and individual empowerment over expert dependency. The ultimate goal should be enabling every Korean consumer to engage confidently with financial planning as a normal part of adult life rather than a specialized skill requiring expert knowledge.

The evidence suggests that while Korean financial literacy scores exceed international averages, the practical application of financial knowledge remains challenging for many consumers. Addressing this gap requires acknowledging that effective financial management involves both knowledge and behavior, both individual skills and systemic support, and both theoretical understanding and practical experience. Only through this comprehensive approach can jaetech become truly accessible to all Korean consumers.